How To Remove 18 Gst From Total Amount In Excel

So the end amount should be 6477. On March 23 2017 the Saskatchewan PST as raised from 5 to 6.

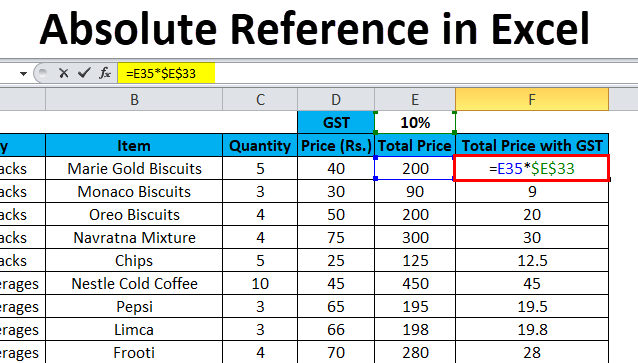

How To Keep Certain Values Constant In Excel Formulas Cell Referencing

Start to removing this Bold and spaces and spending a Huge time unknowingly data deleted May be.

How to remove 18 gst from total amount in excel. Net Price Original Cost GST Amount. You can also calculate the value of your product with tax in a single formula. See the articleTax rate for all canadian remain the same as in 2017.

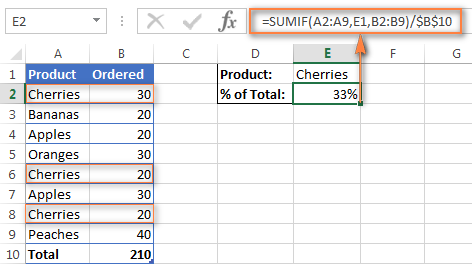

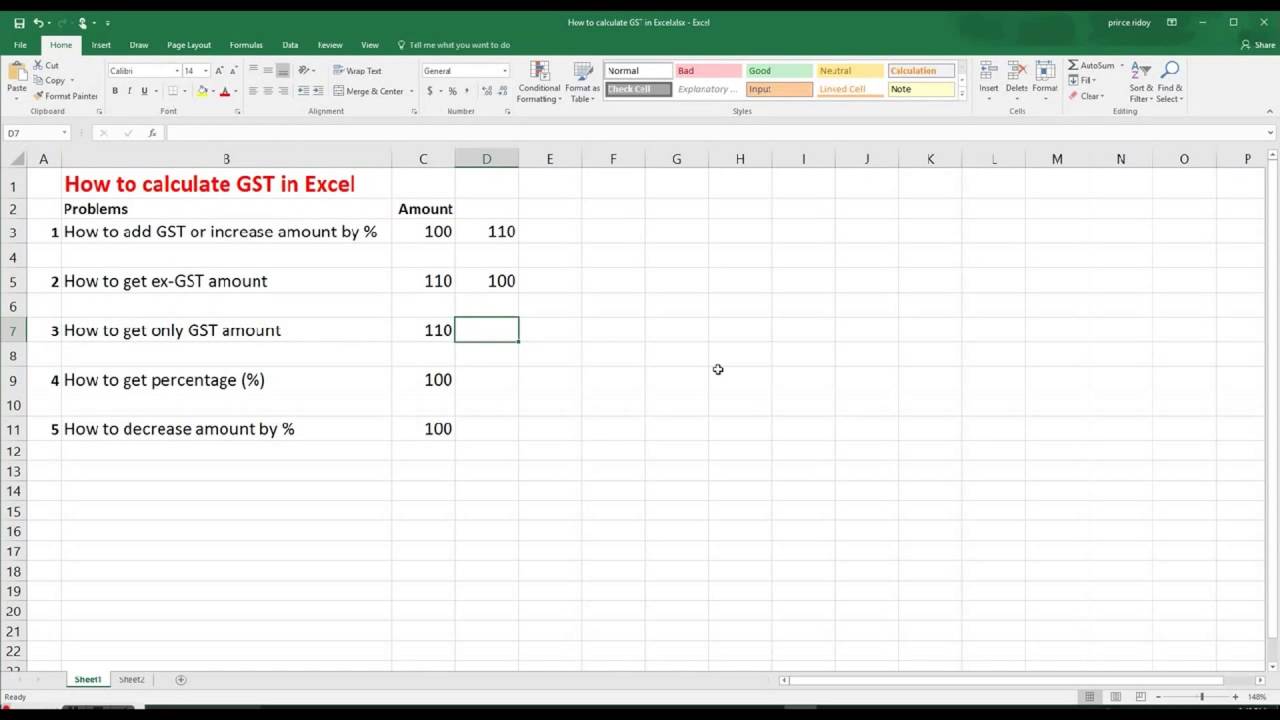

GST calculator is one of the steps to simply hassle for the taxpayers so in this article let us understand how GST calculator helps us to calculate the GST reverse charge. This Excel tutorial shows different techniques to calculate and find GST amounts. Net Price Original Cost GST Amount.

1000 and the GST rate applicable is 18 then the net price calculated will be 1000 1000X18100 1000180 Rs. Final_price base_amount 105. In the example if your bill including GST was 229 then 229 divided by 105 equals 21810.

GST calculation is quite simple. Therefore looking at the increasing amount of the taxpayer it was necessary that there should be some beneficial factor for the taxpayers to complete the process easily. If a goods or services is sold at Rs.

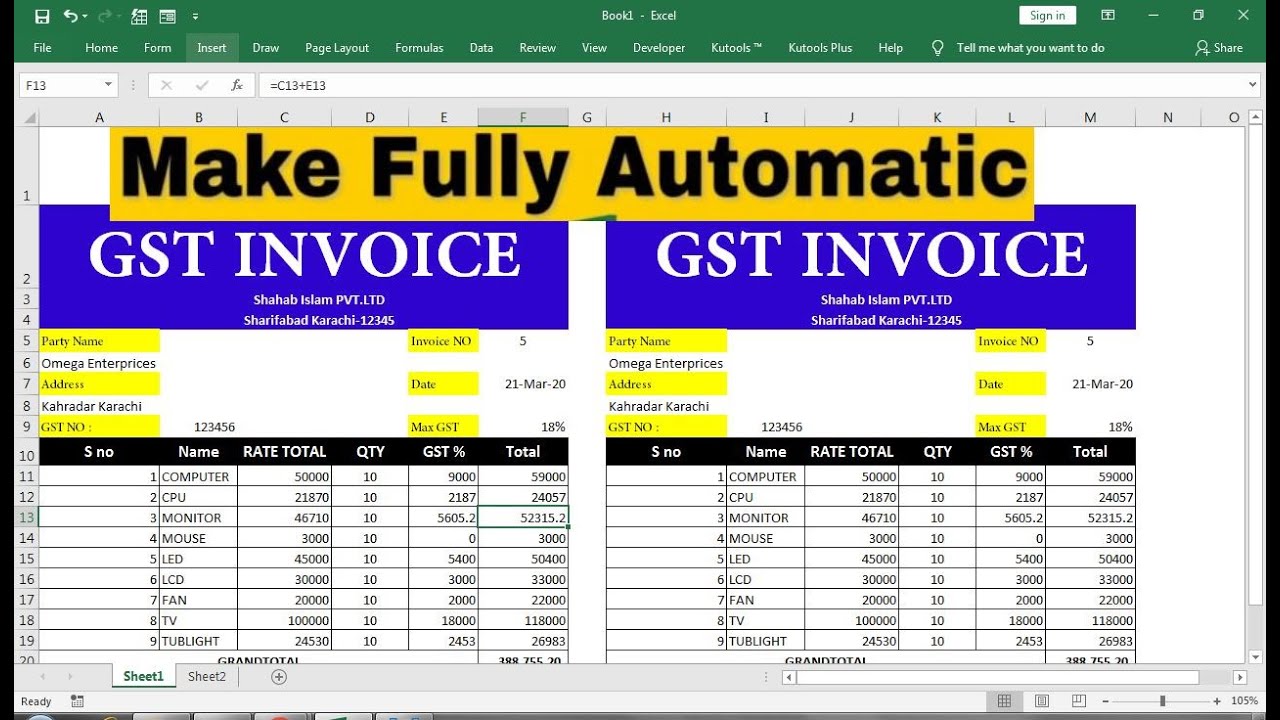

Example of GST Calculation. Then add these two Amounts in Column D You will be presented with the Tax Amount. Current HST GST and PST rates table of 2021.

Subtract this number from the amount you paid to find the original price of the item without GST added on. Subtract your bill without GST from Step 2 from the bill for the goods or services with the GST to find the GST. Also we consider GSTR 2A changes could be happen for an hour or a day or a week.

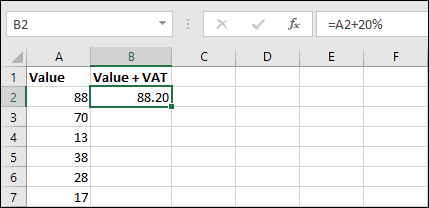

Formula to add the price and the tax. Theoretically you can calculate amount of GST included by following formula -GST Amount Original Cost GST 100. First we take the price of the product 75 And we add the calculation of the amount of.

As you read this article you may own a PC or a mobile device. Every time we have to spend a time for removing these spaces Bold characters to reconcile. Here are two scenarios.

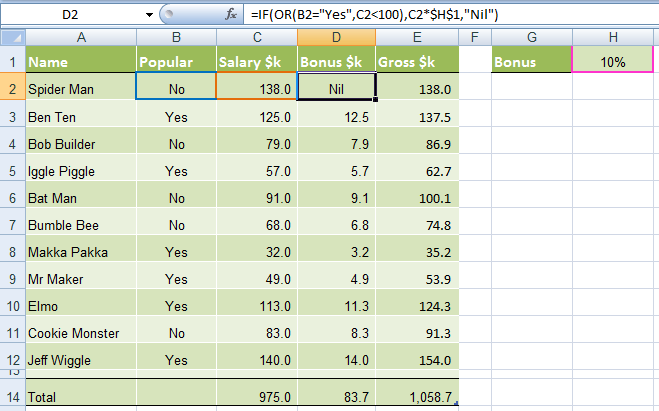

GST or Income tax formula in excel. Here I Introduce GSTR 2A Online Data Space Bold character Tool. Multiply by 3 divide by 23.

And now write the percentage of tax in column B. How can I remove the tax from a total to get the pre tax value. I need a formula that calculates the -5 GST I can not just subtract Total - GST PRICE 1999 1999 1999 SUBTOTAL 5997 PST 8 480 GST 5 300 TOTAL 6777 TAKE OUT GST SOULD BE 6477 6454 X.

Then apply the Tax Amount Calculator formula in column C as shown in the picture below. The formula for GST calculation. Multiply the amount you paid by the decimal you found in Step 2 to find the total amount of GST on the price of the item.

Now first of all write down the amount you want to calculate tax in column A. Our GST calculator will calculate the amount of GST included in a gross price as well as the amount you should add to a net price. Original Cost Net Price - GST Amount.

Base_amount is a price before GST is applied GST base_amount 005. Explanation of the calculation. The main mistake most people can make in calculating the net price of goods is to simply minus 10 from the total price.

Lets say we have a product that is 100 GST inclusive. GST Amount Original Cost x GST100. In order to add GST to base amount Add GST GST Amount Original Cost GST.

If I try to remove 175 UK Value Added Tax from a total its also calculating the additional 175 on the original value as well. GST Amount Original Cost Original Cost x 100100GST Net Price Original Cost GST Amount. To calculate the GST on the product we will first calculate the amount of GST included then multiply that figure by 10 The.

Divide the bill for the goods or services by one plus the GST. GST Amount Original Cost - Original Cost x 100100GST Net Price Original Cost - GST Amount. You have price without GST and you need to calculate final price including GST.

Base_amount 100 GST 100 005 5 and final_price 100 105 105. This also helps you do some practice in Excel------Please watch. Example shown 300 is the GST amount.

For example if you paid 10 for an item you will have paid five percent or 50 cents in GST. This is your bill without GST. GST Amount Original Cost x GST100.

Lets see the calculation in practice. Net Price Original Cost GST Amount. For calculating GST a taxpayer can use the below mentioned formula.

Formula for GST calculation. Price including VAT Price Tax To calculate the price including VAT you just have to add the product price the VAT amount.

Absolute Reference In Excel Uses Examples How To Create

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

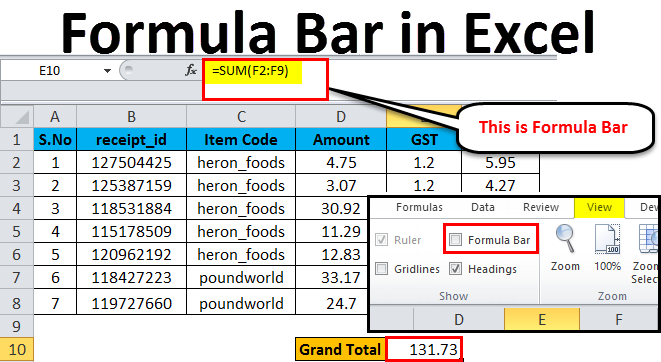

Formula Bar In Excel How To Use Formula Bar Formula Examples

Best Excel Tutorial How To Calculate Gst

How To Keep Certain Values Constant In Excel Formulas Cell Referencing

Medical Bill Format In Excel Template Xls Excel Templates Medical Billing Excel

Howto How To Find Percentage Formula In Excel

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

How To Calculate Sales Tax In Excel

Automatic Gst Calculation In Excel Youtube

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

Excel If And Or Functions Explained My Online Training Hub

Adding Vat To A Value In Excel Thesmartmethod Com

How To Calculate Sales Tax In Excel

Inventory Tracking Template Calculates Running Tally Of Etsy Excel Inventory Management Templates Personal Budget Template

Formulas To Include Or Exclude Tax Excel Exercise